Tony Seba talks about the “Rupture Point of Disruption” and he says there are 3 disruptions 8 technologies that are changing our world. Energy, transportation and food are being disrupted by 8 key technologies. He does not focus on 2 other disruptions in most presentations: information and materials. These are covered by Cathie Wood from Ark Invest who says there are 5 disruptions and 14 technologies. Ark Invest frames these in the context of making money from companies involved in the technologies. (Read More here) Some think that technology change is like gravity. Costs fall without any impact. Few notice as it can take decades and people don’t take any notice! Most people only notice when the technology smashes into the floor, and they realise the world has changed.

Another analogy is a skydiver. When you look up at them they are a speck in the sky. But within minutes, they land. Most of that journey down they are imperceptible and do not appear to be moving. It’s only for the last 10% of their journey are they discernable.

That is one reason many smart people, in smart organisations, get predictions for the future, wrong. They see the skydiver, like us cannot see gravity.

3 Disruptions

- Energy

- Solar

- Wind

- Batteries

- Transportation

- On demand EVs

- Autonomous driving

- Food

- Precision fermentation

- Cellular agriculture

RethinkX says there are 2 other disruptions 4) Materials and 5) Information but has not provided detailed analysis.

Convergence of multiple technologies causes Disruption

Seba describes 5 foundational components of society. Information, energy, transport, food and material. Every time over the past millennia, whenever there has been a 10X change in cost, we got a new societal power. The bronze age, the steel age, the industrial revolution, gunpowder, steam engines, cars and the information age. When we see a convergence of multiple technologies, we get disruption. Technology by itself is unlikely to disrupt society. The mobile phone is a combination of battery, camera, RAM costs, sensor costs, touch screens, mobile networks. A breakthrough is also associated with a collapse of the old systems. Both happen at the same time.

Disruption 1. Energy

The disruption point for solar happened in 2020. Solar is now the cheapest form of energy on the planet. In history. Without subsidies. When you combine 4 hours of battery and solar, disruption is inevitable. It is not just cheaper; it is cheaper than the marginal operating cost for a coal or gas plant. (Even if you could lease the plant for free.) All new projects are wind, solar or batteries. Wind, battery and solar are technology, not fuel. The falling cost is contributing to lower and continuing lower cost of energy.

Solar PV has doubled in volume every 3 years and reduced in cost by 15% each year since 1994. In 1972 it was $100 per watt. Now it is $0.20/W. Lithium-Ion batteries have decreased in cost 97% in 20 years (16% per year) and are now down to under $130/kW. Note that battery cost down was due to consumer electronics, and was not dependent on electric vehicles. Further cost downs will be driven by EVs, wind, and grid energy storage. Other technologies such as Geothermal may play a role. But not nuclear.

Energy with 4 technologies (solar, wind, batteries and information technology) is the energy system. It is, in total, cheaper, more reliable, and cleaner than using coal or gas. For 30 years experts said this would not happen. Just not possible. But the combination of technologies underpinning has disrupted burning rocks.

Key Point: Batteries, Wind, Solar are Technology, Not Fuels

Batteries, wind and solar are not fuel. They are not consumed. At the end of their economic life are recycled and used again. The free energy (sunlight, wind, wave etc) are infinite. Free.

Between 2000 and 2020, renewable power generation capacity worldwide increased 3.7‑fold, from 754 gigawatts (GW) to 2,799 GW, as their costs have fallen sharply, driven by steadily improving technologies, economies of scale, competitive supply chains and improving developer experience. Costs for electricity from utility-scale solar photovoltaics (PV) fell 85% between 2010 and 2020.

Failure to understand solar, wind or batteries are not “fuel” means many still cannot see how this will play out over the next decades.

- Coal, gas, wood, uranium are fuels. Finite. Therefore fuel cost is dependent on finding new sources, extraction (mining) costs, transportation, and costs of waste and remediation.

- Technology is not geopolitical. There is no spike if the members of OPEC stop production.

- Local production. No ships. No trains. Instead of shipping fuel around the world, the energy from wind solar batteries will mostly be consumed locally. Some countries such as Japan may move to offshore wind.

Disruption 2. Protein

RethinkX in their report Food and Agriculture says change is coming for food and agriculture. Like those who thought energy was not going to be disrupted, most consumers, farmers and their grower organisations do not see these technologies driving towards convergence. Unlike major food corporations who are spending billions. There are 2 different areas, dairy protein and meat protein and they rely on 2 primary technologies, precision fermentation, and cellular agriculture. Conventional agriculture and food will change dramatically – all the crops used for food for dairy and beef animals will free up 70% of all intensively farmed agricultural land.

Technology 1: Precision Fermentation

The fermentation process for beer which has been used for millennia, has been changed to be precision fermentation for fat and protein. Insulin was the first of precision fermentation, and the improvement is we can now produce collagen, fat, and proteins. with precision fermentation. Milk, and the agriculture sector is based on getting 3% casein from dairy cows.

Technology 2: Cellular Agricuture

The advancement of DNA technologies, genomics, AI and technology now means we can design yeasts and processes that take simple base material, and therefore all the agriculture inputs that go into dairy can now be made in a fermentation vat with precision fermentation, and the right cellular processes.

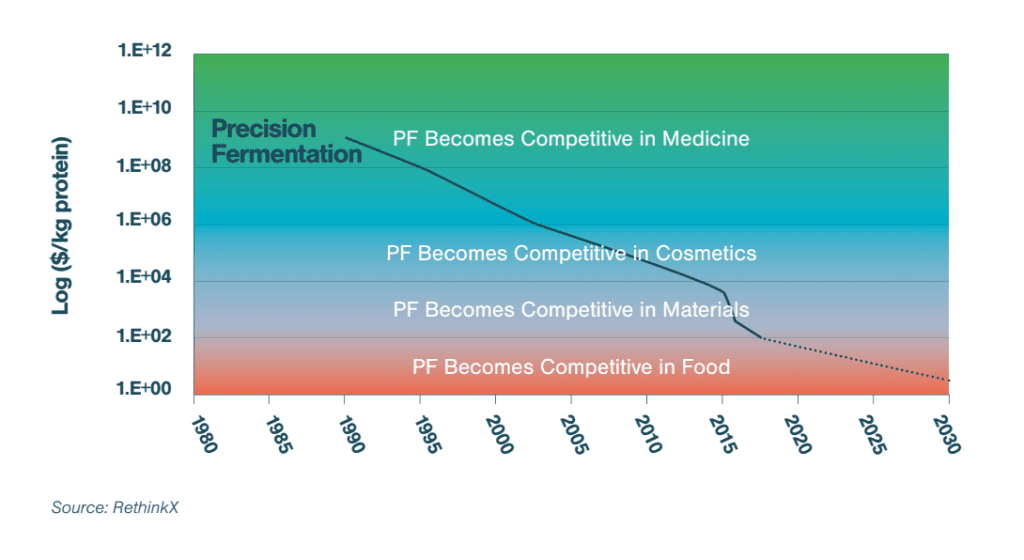

2 Decades of Protein Cost Reduction

- Casein protein currently trades at about $10 per kg.

- Cows produce casein in their milk at about 3.% concentration – the rest is water 90% and some sugar.

- Twenty years ago (2000), the cost of precision fermented protein was $1m per kg.

- The cost has dropped 10,000 times to 2019 to $100 per kg in 2019. (100x per decade).

- Genetics, computers have been the primary technologies for cost down and continue to accelerate.

- Within the next decade, the cost of precision fermentation will be $1 to 2per kg by 2030. (Even if the rate of change is not 100x but only 50X

- By 2024/26 the protein in a protein bar or protein shake will change from cow sourced to precision fermented protein. 1/3rd of the dairy protein market will disappear.

- Yoghurt and cheese and other dairy products may take another 2 years, and that is further 1/3rd of casein use.

- Thiis change can occurr without any consumer change.

- The dairy industry is facing a 90% reduction by 2030.

Meat Protein Changing

Alongside the dairy protein manufacturing, we also so the change in meat protein. Ground beef is about 50% of the beef used today. Replacement of the ground beef industry will be the first change – again most consumers will not notice any difference it the food product. It has been enabled by the development of a vegetable protein – called “Heme”. Heme is a precision protein, and tastes and feels like meat. Heme is only 2% of the burger. That disruption of the beef meat industry and the chicken meat will be as rapid and as deep as the dairy industry. It will take longer replace the more complex beef steaks etc.

Disruption 3. Transportation

Transport disruption will be the result of 2 different technologies. Electric Vehicles and Transport as a Service

EVs Technology

Seba in 2010 predicted that by 2020 the market would offer EV unsubsidised 200-mile range cars cheaper than the median cost of cars in USA. Today, $38,000 is the median car price in the USA. There are now many EVs from China that are under $20,000. The rupture is happening today. Seba predicts this proportion will accelerate as EV new cars were over 10% in 2021. Seba also predicted in 2014, that by 2025, we will have $15,000 EV cars. That has already happened in China.

EVs can already drive 500,000 with the promise of 1m miles. ICE cars do about 140,000m. With a lifetime of 10 times further the cost of capital is compelling. The choice for a business is you can use 1 EV or 7 gasoline vehicles. Fleet use with EVs makes economic sense today and simply $$$. Not green. All fleets will have to go to electric in the next 5 years or they will be uneconomic. So you are already seeing Hertz buying 10% of their fleet with a 100,000 purchase. Amazon has bought 100,000 delivery vans and wants 20,000+ per year. Electric vehicles offer:

- Longer lifecyle

- Lower maintenance costs

- Free energy

Autonomous Vehicles

Change is not going to take the old transportation system and electrify it. Autonomous vehicles provide cost benefits far exceeding EV by themselves

- The day level 4 autonomous is approved the cost of transportation falls 10 times. From 80c to 5c per mile.

- AV removes the labour cost from transportation (1/3rd of the cost)

- Selling less cars

- Cost of fleet cost down by 10 times

- We will stop buying cars, and Osbourne effect is already in play.

- The global oil industry will be disrupted by EVs. That disruption will accelerate.

- The Health / Hospital system will lose 20% of their clients. Which will disrupt the health industry.

Characteristics of the 3 Disruptions 8 Technology Scenarios

These disruptions share common elements. Relentless cost curves. Substitution of labour and materials. Consumer demand.

Burning Stuff for Heat and Electricity

For the first time since we learnt how to stand up and walk, we don’t need fire. We learnt to burn stuff for cooking and heating energy nearly a million years ago. We no longer need to. Stop burning stuff. Additionally, we also are substituting human labour with robotics and technology.

Relentless Cost Curves

Cost curves are relentless. Just like gravity, costs drop. Batteries or solar since 1970 pricing cost of technology keeps dropping. While it is dependent on investment and scale and research and development, the pace of reduction is somewhere between zero and 30%. Lithium-ion batteries for example have decreased at 16% per year, but over 2 decades have decreased by 97%. A 20% reduction in cost year on year means the cost halves in 4 or 5 years. Like gravity, the cost down is happening and no one sees it until it hits the ground. Experts are lulled to sleep. The rupture point is the point when that technology hits the ground and combines with other technologies. Once the technology gains 10% of the market, and that may take 2 decades, the market tips and it takes only another decade the adoption of those technologies are at 80% or more.

Some technologies hit a wall and do not progress. E.g. Internal combustion engines hit the wall 100 years ago. There has only been incremental improvements of less than 1% per year every since.

No Silos

Cellphones drove the cost of batteries down and EVs used those same batteries to drive the costs down in the car industry. With technology, there are few silos. Innovation in one area can be used elsewhere.

Fulfilling Demand Drives Growth

Will there be a slow down due to minerals? 2030. Will the supply of minerals be a barrier? EV and factories are exponential, mining is linear. There is more than enough known lithium. Not just availability but now that EV is the dynamics in mining going to flip. Companies generating demand to companies fulfilling demand. EV companies will need to invest. Supply will be a determinant and lithium will need to increase over 13 times but investment and R&D will support the growth of EV/AV.

3 Disruptions Enable Net Zero Climate Change

Tony Seba says that 3 disruptions in energy, transportation and food, driven by 8 technologies, will allow us to achieve zero emissions by 2035. Furthermore, it will address the CO2 increase we have already accumulated and be a negative zero by 2050. While political barriers may hinder, technology and economics will override politics.

Faster Horse Fallacy

For a full explanation check out faster horse fallacy where Tony Seba explains phase change disruption. AS he points out smart people in smart organisations fail to see it is not a 1:1 substitution. The new system will not be a “faster horse”.

Reduction in Carbon Cost of Transportation

The disruption of transportation will also reduce carbon cost by 10 times

For this talk checkout CleanTechnica.com podcast. (Paywall)

5 Disruptions, 14 Technologies from Cathie Wood Ark Invest

The disruptions are

- Robotics

- Energy storage

- AI

- Blockchain

- DNA Sequencing

Ark Invest Technologies for Disruption

Ark Invest CEO Cathie Wood talks about 14 technology disruptions as core to the 5 societal disruptions, and Ark Invest is investing in companies who provide that technology. Ark Invest has 6 EFTs (Exchange traded funds) that focus on different areas, and the companies they invest in are in their factsheets.Tony Seba of RethinkX Transport, Energy and Food Disruption has a more general view and provides only overall industry information.

Missing from ARK are 2 key technologies for Seba: solar and wind technologies, whereas Ark Invest says these already exist, and there will be improvements but they have already disrupted the industries.

| # | Ark Invest Technology | Ark Disruptions | Seba Disruption | ARK-K | ARK-Q | ARK-G | ARK-F | ARK-X | ARK-W |

|---|---|---|---|---|---|---|---|---|---|

| No. | Technology | 5 Disruptions | 3 Disruptions | Innovation | Autonomous & Robotics | Genomic | Fintech | Space | Next Gen Internet |

| 1 | Artificial Intelligence | Robotics, Energy | Transport, Energy, Labour | 5.3% | 12.1% | ||||

| 2 | Digital Consumer | Finance, Energy | Energy, Transport | 22.2% | 43.0% | 12.8% | |||

| 3 | Digital Wallets | Finance | 27.4% | ||||||

| 4 | Public Blockchains | Finance | 5.0% | 13.8% | 14.7% | ||||

| 5 | Bitcoin | Finance | 8.6% | ||||||

| 6 | Ethereum and DeFi | Finance | 28.4% | ||||||

| 7 | Web3 | Finance | 38.4% | 33.7% | |||||

| 8 | Gene Editing | Food, Health | Food | 6.7% | 50.0% | ||||

| 9 | Multi-Omics | Food, Health | Food | 16.8% | 50.0% | ||||

| 10 | Electric Vehicles | Transport | Transport | ||||||

| 11 | Autonomous Ride-Hail | Transport | Transport | 2.7% | 37.5% | ||||

| 12 | Autonomous Logistics | Transport | Labour | ||||||

| 13 | 3D Printing and Robotics | Manufacturing | Transport | 7.0% | 34.0% | 32.0% | |||

| 14 | Orbital Aerospace | Transport | 1.5% | 7.3% | 24.0% | ||||

| Energy Storage | In Electric Vehicles, Transport | Energy, transport | 15.6% | ||||||

| Wind (Seba) | Existing energy | Energy |