A recent policy and funding update for gas in Australia was released in early May 2024 [1] and Australian gas exports will crash, or at least that is the conclusion if you look behind the numbers. The actual announcement says new gas fields are key to the government’s strategy of gas as a transition to net zero emissions. Climate groups say this will be ‘devastating’ to emissions reduction targets, [2] with this climate plan supporting temperature rises of 2.5° to 3.0° with 1.5°C passed by 2028. We have looked at domestic consumption and can see 71% of all gas from Australia is exported. In fact more is used to process gas than used by households.

Emissions are Still Rising

A LOWER carbon future will not be sufficient to arrest climate change. What is needed is Net ZERO carbon – ie stopping the sale of oil and gas to customers who do not capture or permanently offset their emissions. Here is increase in temperature trends. Moreover, methane emissions from gas extraction and processing are high, and carbon capture and storage (CCS) is a scam as we have shown elsewhere.

Australian Gas Exports Will Crash To These Countries

The latest export revenue trend since 2008 show a rise from 15Mt to over 80MT

The key export markets are

- Japan revenues ($24B)

- China ($13.9B),

- South Korea ($13.1B),

- Chinese Taipei ($9.4B),

- Singapore ($1.81B).

China is exiting imports of energy as fast as it can, with explosive growth of over 500GW of solar and wind and batteries and imports decline. By 2030 will be using substantially less. By 2035 it is probable to be minimal, and Japan, Taiwan and Sth Korea by 2040. The gas industry is saying IEA and RMI forecasts are wrong. Others such as Rystad have saying fossil fuel will be mostly gone by 2050.

Industry Will Reduce Consumption

Jacobson in 2024 [3] forecast that using firebricks may reduce fossil fuel consumption by replacing with renewable energy. Firebricks are refractory bricks that can, with one composition, store heat, and with another, insulate the firebricks that store the heat. Because firebricks are made from common materials, the cost per kilowatt-hour-thermal of a firebrick storage system is less than one-tenth the cost per kilowatt-hour-electricity of a battery system. Most countries have industry that can use excess renewable electricity to produce and store industrial process heat. Firebricks can provide a low-cost source of continuous heat for industry. They state using firebricks, that the savings include:

- 2050 battery capacity by ∼14.5%

- Annual hydrogen production for grid electricity by ∼31%

- Underground low-temperature heat storage capacity by ∼27.3%

- Onshore wind nameplate capacity by ∼1.2%

- Land needs by ∼0.4%

- Overall, the annual energy cost by ∼1.8%

Uncontracted Gas Supply for Australian Exports

Data from IEEFA says the future of Australian gas is bleak. [4]

Australia would be competing with Qatar. Both countries have similar uncontracted supply and so prices are likely to fall.

Australia Is High-Cost Supplier

Australia’s high costs and impending supply glut is likely to see export volumes decline over the next decades.

Decommissioning Stranded Assets

Austrlian taxpayers face risks arising from the decommissioning obligations of the oil and gas industry. A rapid phase-out of oil and gas could mean companies won’t meet their obligations. The government becomes the ” decommissioner of last resort”. The cost of decommissioning? The liability is estimated at more than $USD 40 billion.

Gas Demand in Europe

It is no just the Asian markets that are reducing their gas demand. EU is.

Competition from Others

Australia has competition from the USA and Qatar

Who To Believe?

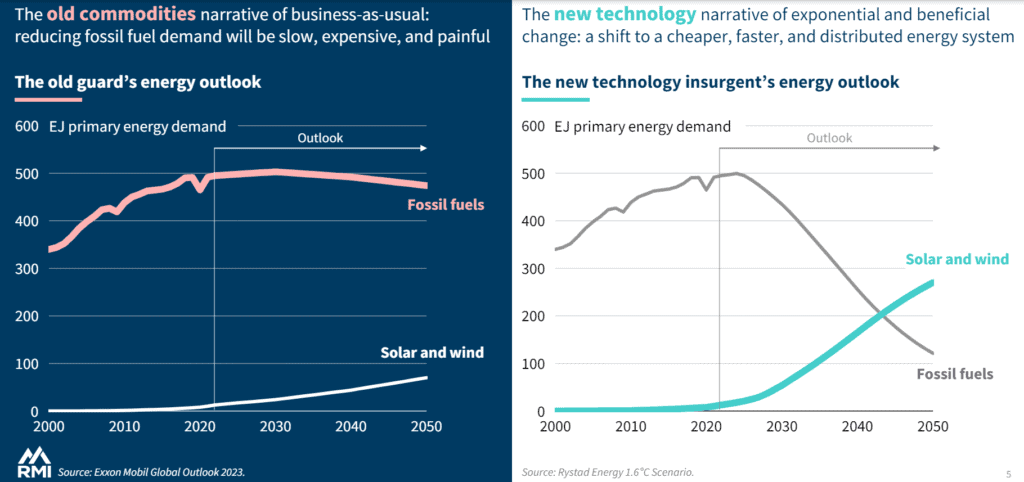

Do you believe the forecasts from the fossil fuel industry, or from a company such as Rystad. Two engineers could have gone to the same university. How do they come up with these 2 different scenarios.

- One works for ExxonMobile

- One is employed by Rystad

References

[1] D. of I. S. and Resources, ‘Future Gas Strategy | Department of Industry Science and Resources’, https://www.industry.gov.au/node/93472. Accessed: May 14, 2024. [Online]. Available: https://www.industry.gov.au/publications/future-gas-strategyhttps://ieefa.org/resources/oil-and-lng-supply-gluts-spell-double-trouble-australian-lng-producers

[2] A. Remeikis, ‘Labor’s gas strategy: what is it and why do critics call it “Back to the Future”?’, The Guardian, May 09, 2024. Accessed: May 14, 2024. [Online]. Available: https://www.theguardian.com/australia-news/article/2024/may/09/labor-albanese-government-gas-strategy-emissions-reduction-policy-net-zero-targets-renewable-energy

[3] ‘Effects of firebricks for industrial process heat on the cost of matching all-sector energy demand with 100% wind–water–solar supply in 149 countries | PNAS Nexus | Oxford Academic’. Accessed: Jul. 29, 2024. [Online]. Available: https://academic.oup.com/pnasnexus/article/3/7/pgae274/7710221?login=false

[4] ‘Oil and LNG supply gluts spell double trouble for Australian LNG producers’. Accessed: Jul. 04, 2024. [Online]. Available: https://ieefa.org/resources/oil-and-lng-supply-gluts-spell-double-trouble-australian-lng-producers

[5] Australia’s great gas giveaway: How Australia gives gas to multinational corporations for free https://australiainstitute.org.au/report/australias-great-gas-giveaway/

[6] RMI Cleantech revolution 2024 https://rmi.org/insight/the-cleantech-revolution/