The phase change of food disruption is happening now, and one of the 5 disruptions that Tony Seba from RethinkX talks about. Three technologies are enabling the change in the 2020 decade, and are information technology, genomics or cellular agriculture, and precision fermentation. For a full analysis it pays to read the document in full at https://www.rethinkx.com/food-and-agriculture. You may find this confronting. Or disagree. If you are a cattle farmer, it is sobering information.

Precision biology

Twenty years ago (2000), the cost of precision fermented protein was $1m per kg. The cost has dropped 10,000 times to 2019 to $100 per kg. (100x per decade). Genetics, computers have been the primary technologies for cost down. Within the next decade, the cost of precision fermentation will be $1 to 2per kg by 2030. (Even if the rate of change is not 100x but only 50X) and this will impact 2 protein markets – meat and dairy.

Infinite Numbers of Proteins Possible

12 plants and 5 animals account for 75% of food. The first 2 disruptions will be dairy and animal protein, but the numbers of proteins are infinite.

- For human proteins for human consumption we now have human insulin, human growth hormone, human collagen and human milk proteins

- For proteins that are too expensive to extract, so we have plant natural products, indigo, vanillla, stevia, cannaboids

- Proteins from extinct plants and animals, mastondon burgers or gummies.

Dairy Protein Cost Reduction

- Casein protein currently trades at about $10 per kg.

- Cows produce casein in their milk at about 3% concentration

- By 2024/26 the protein in a protein bar or protein shake will change from cow sourced to precision fermented protein. 1/3rd of the dairy protein market will disappear.

- Yoghurt and cheese and other dairy products may take another 2 years, and that is further 1/3rd of casein use.

- The dairy industry is facing a 70% reduction by 2030.

- Before this, the US cattle industry will be effectively bankrupt.

- By 2035, this will be close to 90% reduction

Beef Protein Production

- The nominal retail price of ground beef in the USA is about $12 per kg .

- Over 40% total, but 60% consumed in the home of is ground beef.

- Americans eat about 26kg of meat per annum.

- The discovery that legume hemoglobin (heme) provides the tastes and mouth feel of meat.

- Haem is only 2% of the burger.

- In 2020, cell meat was less than 1% of the market, but rapidly growing

- The first major meat disruption will be in pet food. Pet food accounts for 24% of meat products in USA. (waste meat) and take profit away from conventional meat.

Other Food Disruption

Humans use 14 species for 75% of the food consumed.

- Chicken, pig and fish will follow similar disruptions

- Crop farming volumes such as soy, corn and lucerne (alfalfa) will fall by more than 50%.

Consequences of Food Disruption

A disruption of the dairy and beef meat industry will be as rapid and as deep as in other technology areas when the cost of protein is 10% of the cost of the existing food chain. That is likely within the next 5 years. The first products today include chicken and ground beef, but diary protein can change without consumers noticing. All the crops used for animal food will free up 70% of all intensively farmed agricultural land. There are 1.2 billion dairy and beef cows. With the dairy and the ground beef market likely to transition to cellular agriculture that leaves only 20% of animals for speciality products, and those will be at risk within another decade.

Tyson Foods is Investing

Tyson Foods’ involvement in alternative protein is about “and” not “or.” They say that alternative proteins, whether from plants or the lab, can co-exist with traditional animal protein. There’s growing global demand for protein of all types. According to one study, 60 percent of consumers in 2017 said they were actively looking to add more protein to their diets, and half of those (30% of consumers) said they were actively looking to add plant-based protein into the mix.

In addition to consumers seeking more choices to fit their lifestyles, there’s a very real need to provide nutritious, affordable protein to the growing world population. The UN predicts a nearly 30% increase in the population by 2050. That’s 9.8 billion total mouths to feed. Tyson say that to meet this demand, they are investing and innovating in traditional animal protein including ways to make meal preparation easier for consumers.

Tyson say that sustainability is at the core of what they do. They say they are the world’s largest producer of no-antibiotics-ever chicken. They have a goal to reduce their greenhouse gas emissions by 30% by 2030. And investing in alternative proteins is also essential to that sustainability strategy. Is this greenwashing?

Food Disruption is happening with Nestlé

Nestlé is betting on both plant-based and lab-grown meat as the future of food. Under its Garden Gourmet brand in Europe, Nestlé offers a variety of plant-based products in the retail and foodservice sector, including the Incredible Burger patty (now “Sensational Burger”) which was featured as part of The Big Vegan TS burger at McDonald’s in Germany. In the USA the Swiss giant owns vegetarian brand Sweet Earth, under which it offers vegan meats such as the Awesome Burger and Awesome Grounds. Nestlé has also modernized some of its classic brands to include Sweet Earth’s vegan meat products such as DiGiorno pizzas and Stouffer’s lasagna. (Report from Veg News)

Food Disruption Industry

| Company | Food Type | Notes | Website |

|---|---|---|---|

| Tyson | Meat & protein | Tyson Ventures, the venture capital arm of Tyson Foods, has made strategic investments in Beyond Meat, Upside Foods & Future | Tyson Ventures, Tom Mastrobuoni |

| Beyond Meat | Meat | ground beef, chicken tenders, tacos, pork, sausage Peas, mung beans, faba beans, brown rice, coconut, Potato starch, methyl cellulose, cocoa butter, coconut oil and expeller-pressed canola oil | Beyond Meat |

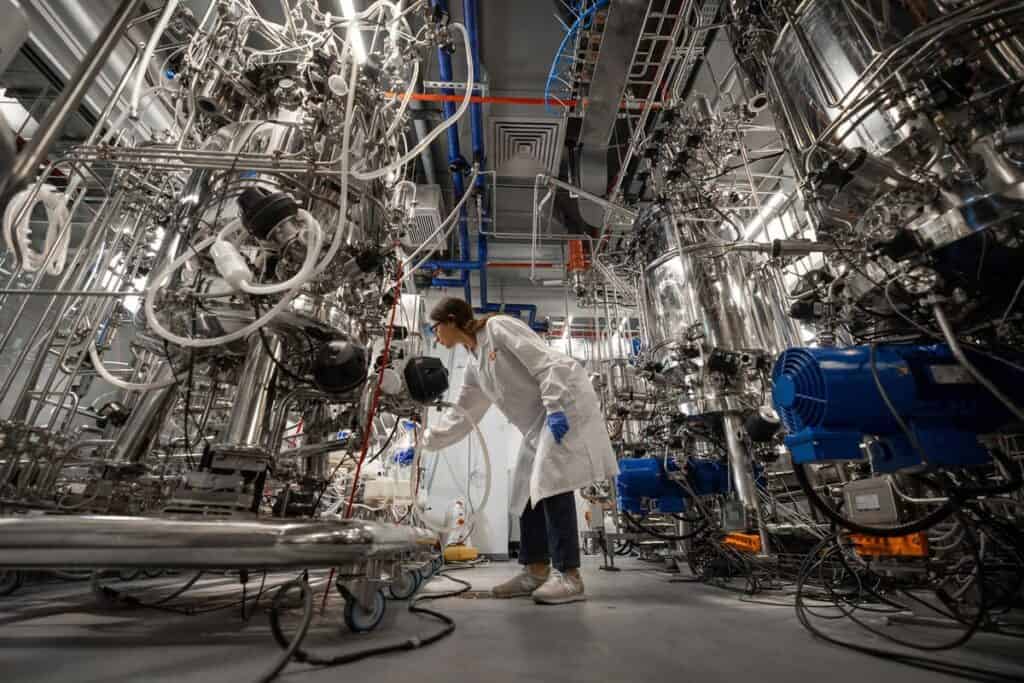

| Upside Foods | Chicken first | Animal cells in a cultivator (aka fermenter) and micronutrients - 3 weeks. Coming soon. Building first plant in San Francisco, with production of 22T/yr increasing to 200 T/yr | Upside Foods had Series B $186m in 2020 from SoftBank Group, Temasek, Norwest, and Threshold Ventures, as well as food industry leaders Cargill and Tyson Foods, and impact investors including Bill Gates, Sir Richard Branson, Kimbal Musk and John Mackey. |

| Wildtype | Fish | Opened in San Francisco | |

| Fable Foods | Meat - pulled pork braised beef beef brisket | Meat product from mushrooms. $5m raise to begin sales in USA. | Fable Foods mushrooms from Australia, Coles, Grill's, Guzmon, and in Singapore |

| Quorn | Meat substitute | Use sachet-sized amount of Fusarium, grow in fermenters, for a few days. The Fusarium venenatum converts carbohydrate into protein, producing ‘Quorn mycoprotein’: a protein-rich, sustainable food source that is packed with fibre, low in saturated fat, and contains no cholesterol. since the 1960s. Imperfect. | Quorn UK website and sold throughout most countries. |

| Meaty | Meat | backed by $28 million from Acre, Prelude Ventures, Congruent Ventures and Tao Capital | Techcrunch review Meati website |

| AtLast Food Company | Meat Bacon | Uses mycelium, the root structure of mushrooms | Forbes Summary of AtLast |

| Impossible Foods | Meat, dairy ,fish | Plant-based heme is made via fermentation of genetically engineered yeast and enables the production of range of products. | Impossible Foods |

Factories can be Situated in Local Communities

Most of these new factories are in cities – without the smell and inputs from agriculture they are high tech. That contributes to low food miles.

Impact on Climate Change

Net greenhouse gas emissions from the sector will fall by 45% by 2030. From cattle 80% by 2035.

- By 2035, lands previously used to produce animal foods in the U.S. could become a major carbon sink with a range of other benefits

- No carbon intensive fertilisers needed.

- 60% less water and irrigation.

- More stable food production (floods, droughts)

- Other issues such as international deforestation, species extinction, water scarcity, and aquatic pollution from animal waste, hormones, and antibiotics will be ameliorated as well.

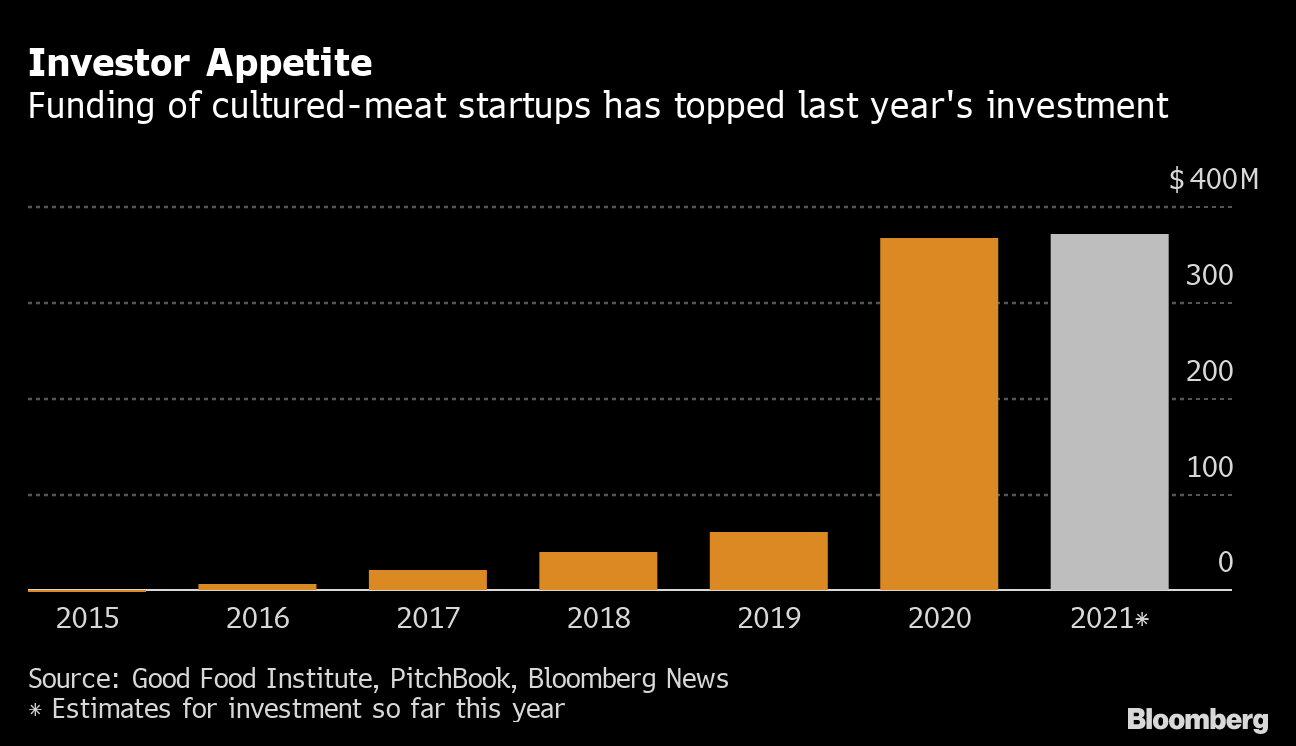

Food Disruption is happening now due to large investments

Disruption By 2030

Precision Fermention is 100X more efficient than Cows

The rupture point is shown on this graph from one of RethinkX talks. Tony Seba says precision fermentation proteins will be at cost parity with animal proteins by 2024/2026.

Australian Investment in Dairy

Change Foods, a start-up backed by Giant Leap raised a record-breaking $15.3 million during its seed investment round this year. The company creates animal-free cheese products using precision fermentation technology, to produce the protein casein, found in dairy.

“They create cheese without cows. So, there’s no need for the land, the water usage, the cows that produce a lot of methane. Basically, it’s cheese grown in a lab.”