A consequence of renewable energy and transition to technology; stopping burning rocks; electrification of energy; recycling and electrification of transportation means that mine numbers collapse by 2040 by 70%. This major change is staring us in the face, but few have looked at the size and rapidness that this change is already on a pathway.

Evidence that Mine Numbers Collapse by 2040 is Inevitable

- 6,000 mines globally. 90% are coal.

- Global mining uses more than 57,000 km² of land

- 50% of land areas are concentrated in only five countries: China, Australia, the United States, Russia, and Chile

- $925b total revenue

- Over 1 million employees in top 10 companies

- 4.7 million employed in coal mining globally and reducing coal mining will have major impact on communities

- Automation in the mining sector is accellerating.

- Coal decline will need to be 80% by 2050 to achieve net zero emissions.

- Electrification of energy grids is already underway in most western countries and most of the worlds coal plants are aging.

- Steel making is already cheaper with electricity than with coking coal.

- Electricfication of transportation has already exceeded 2% in the USA, Europe, Australia and China. In Norway it is 100% but even in Shanghai in China EVs are more than 50% of all new cars.

- The rate of change is increasing exponentially. Not linear. Speed is dependes on supply of renewable energy and batteries only. how fast the electriciation of grids and transportation is.

Types and Production of Mines Globally

The majority of mines globally are fossil fuel. The four biggest suppliers of seaborne iron ore—Rio Tinto, BHP, Fortescue Metals and Brazil’s Vale—account for about 70% of world trade and about 80% of China’s imports. With China Iron ore mines will probably not decrease due to demand for steel in construction and infrastructure. In contrast the thermal coal will decline with increase in renewable energy, but coking coal for making iron ore to steel is set to be transformed by using “green” steel.

Biggest Mining Countries

Like China, many countries in the top 10 of the world’s biggest miners relied almost exclusively on mineral fuels. Saudi Arabia’s and Indonesia’s share of mineral fuels of all mining output were 97 percent and 99 percent respectively. Australia and Brazil extract between 45 and 55 percent iron (including ferro-alloys). The United States is heavily relying on mineral fuels for its mining industry. Their share stood at 94 percent in 2017 – divided approximately equally between coal and petroleum..

If by 2040, coal mining has gone, how many mines are left? Will renewable energy take up the slack.

- Copper demand in EV vehicles is expected to increase 4 times (Rio Tinto) E.g. a 1MW wind turbine needs more than three tonnes of copper.

- Nickel by multiple times (Sumitomo Metals) driven by electrification of transport. E.g 20% increase from 410,000 tonnes in 2022 from nearly 330,000 tonnes in 2021.

- Lithium from 450,000 tonnes to 8 million tonnes pa

- Tesla estimates that to fully electrify the grid and transportation they will need about 300TW of batteries. This will take about 2 decades.

Battery Recycling will Lead to No More Mines by 2040

Redmond Materials and recycling of wind turbines and solar panels will mean these become the majority source of the materials. New materials may only need 10% of the minerals that are used. With EV manufacturers and battery manufacturers with offtake agreements with the recyclers, it will be a circular economy.

That implies we would need at most 10% of the current mines. By when? 2030? 2040?

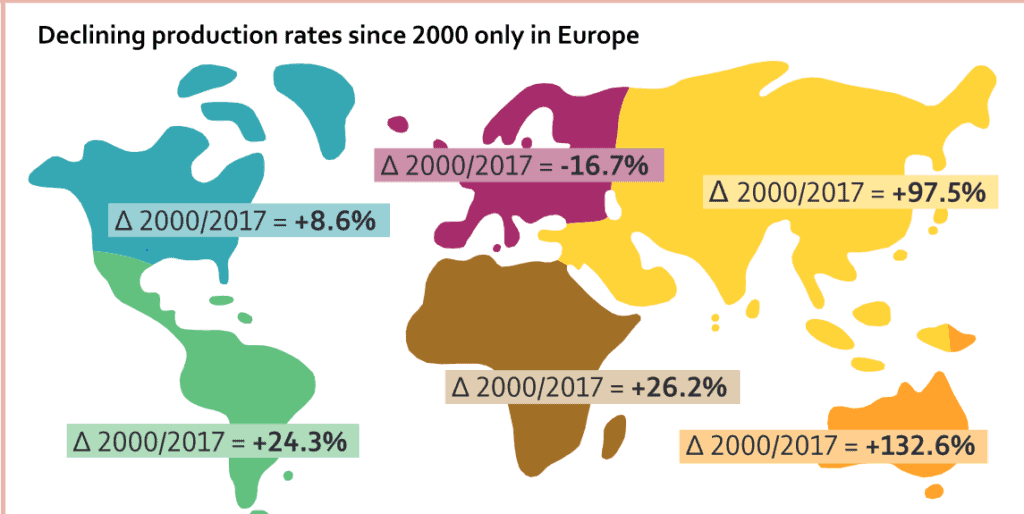

Mines Increased in Past 2 Decades

Impact on Miners

Australia has 39,000 miners. Most will need to be redeployed due to shutdown of coal mines and automation. New mines will not need the same number of employees. These 10 companies below employ over 1 million, mostly coal miners out of a total of about 4.7million total. Many of these are in local cost mines in India and Africa. They are at risk of job losses due to automation.

The World Bank has a paper “Global Perspective on Coal Jobs and Managing Labor Transition Out of Coal”

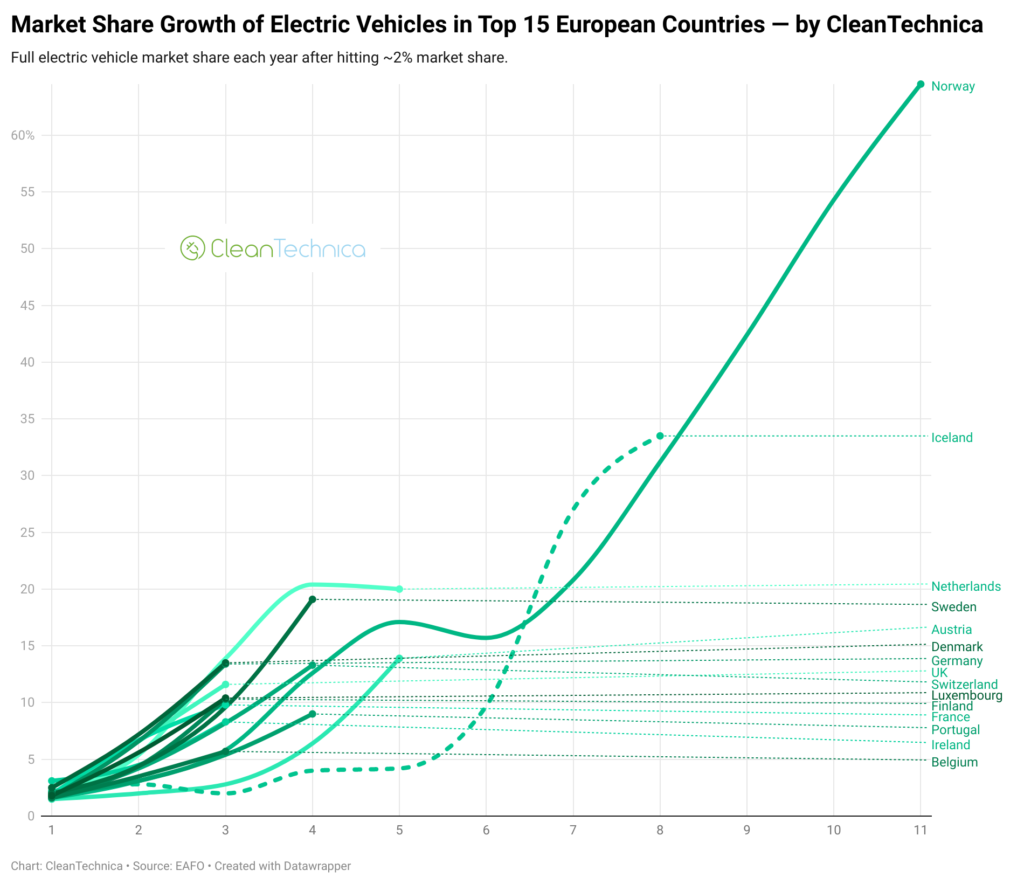

Exponential Change in EVs is Already Occurring

Cleantechnica show there are now 15 European countries that have 15% or more of new-car buyers buying plugin electric cars (full electric cars or plugin hybrids). There are 12 European countries that have 10% or more of new-car buyers buying full electric vehicles (BEVs). China also passed those milestones in 2021 (15% plugin vehicle share and 12% BEV share). The data shows several countries have gone from ~2% of new car sales being fully electric to 10%+ being fully electric in just two years. It took Norway three to four years to make a similar climb. The question now is: does the growth level off a bit or does it keep spiking in these countries?

Increase in Non-Ferrous Minerals

- Nickel demand expected to double – Nickel for Batteries)

- Lithium demand to increase by 20 times – Lithium for batteries

- Cobalt – slight increase Cobalt in Batteries

- Copper – the third most consumed mineral needs a further 10m tonnes per year for renewable energy infrastructure – Copper for renewable energy