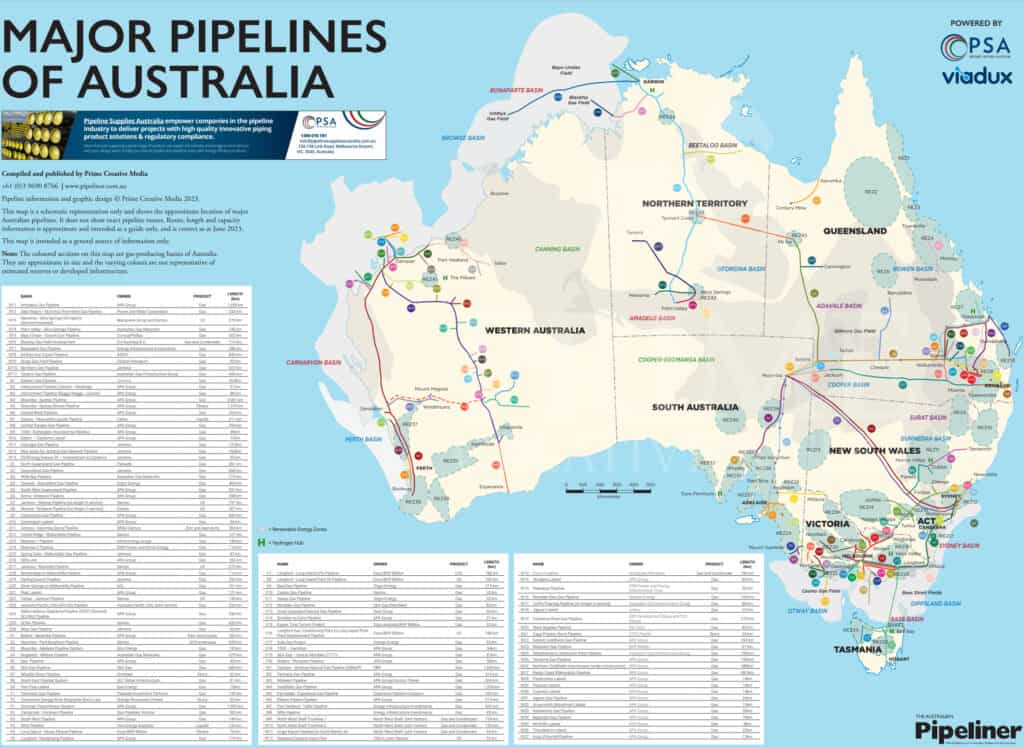

Ben Potter has a simple overview of the stranded gas assets in Australia. He presents details of who, how much is at risk and what consumers are likely to have to wear as the gas transitions out of Australia’s electricity and energy mix. More information is in this article on gas transition to electric on this site. This article Death spiral: Network blows up renewable gas claims, wants to hit consumers for cost of stranded assets. He points out state’s gas households would have to pay about $220 million more for pipelines over the five years to 2028 than was agreed with the regulator just two years ago.

Existing Networks

- Victoria = 2.27 million gas customers

- NSW = 1.5 million

- South Australia = 472,000

- ACT = 157,000.

The four jurisdictions’ gas distribution networks are worth a combined $10.4 billion. Most are overseas owned. Australian Gas Infrastructure Group, which owns Multinet Gas Networks and Australian Gas Networks is owned by Hong Kong’s Cheung Kong Group.

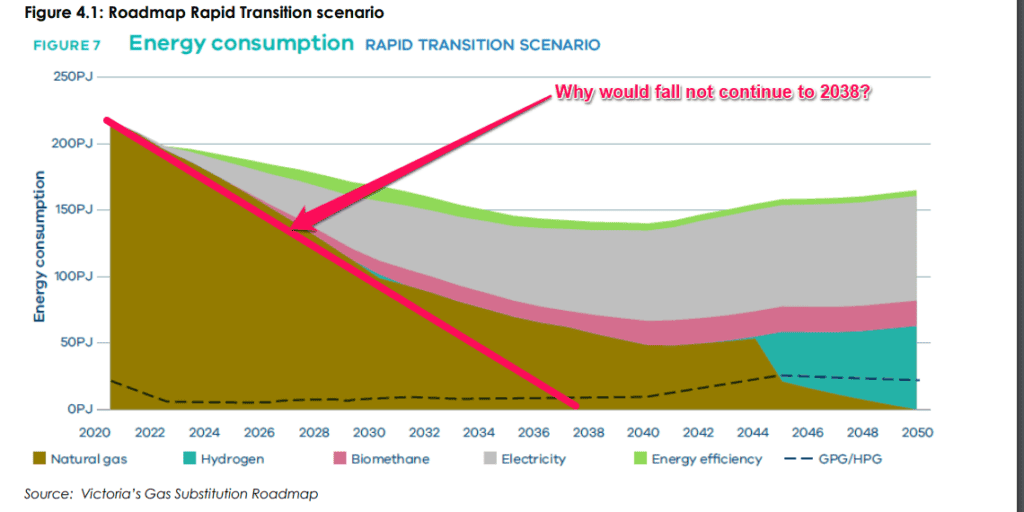

Victoria Demand Roadmap

Even Ausnet can see a fall in energy consumption, in a rapid transition scenario that sees Energy consumption fall from 210PJ to 50PJ in the next 15 years. Some enthusiastic analyst shows hydrogen changing over from 2045. What makes no sense is if gas falls from 2020 to 2030, why would that fall not continue to zero by 2038? What do they see the reasons the change to electricity does not continue?

Key Points:

- Accelerated Electrification: Victoria’s push to electrify homes and businesses is accelerating, impacting gas network companies like AusNet Services.

- Stranded Assets: Gas network companies fear their assets will become stranded as more households and businesses switch to electricity.

- Cost Implications: These companies are seeking to charge customers over $200m over the next five years. It is for increased pipeline depreciation to recover their investments and account for accelerated depreciation.

- Renewable Gas Uncertainty: The future of renewable gas, such as hydrogen and biomethane, as a viable option for household energy supply is not a viable solution.

- Policy and Regulatory Challenges: Governments and regulators face the challenge of balancing the interests of energy companies, consumers, and the environment.

Notable Insights

The rapid shift towards electrification is creating significant challenges for the traditional gas infrastructure. The debate over cost allocation, policy certainty, and the role of renewable gas highlights the complexity of the energy transition. As governments and industry grapple with these issues, consumers may face higher energy costs in the short term, but long-term benefits such as reduced emissions and increased energy security are potential outcomes.

Potential Biases or Misinformation:

The article primarily focuses on the concerns of gas network companies. It’s important to consider the broader perspective, including the potential benefits of electrification, such as reduced greenhouse gas emissions and improved air quality. Additionally, while renewable gas technologies are still emerging, they may play a role in the future energy mix, particularly for hard-to-electrify sectors.

Key Takeaways:

- The energy landscape is undergoing significant transformation.

- Gas network companies are facing financial challenges due to accelerated electrification.

- The future of renewable gas remains uncertain.

- Policymakers and regulators need to balance the interests of various stakeholders.

- Consumers may face increased costs in the short term, but long-term benefits are potential.

- AusNet’s variation claim would lift the combined accelerated depreciation bill to about $554 million,. That is more than $100 million a year for the state’s 2.27 million gas households.

- Other states do not have the aggressive phaseout that Victoria has adopted.

References

- Death spiral: Network blows up renewable gas claims, wants to hit consumers for cost of stranded assets Nov 2024 https://reneweconomy.com.au/death-spiral-network-blows-up-renewable-gas-claims-wants-to-hit-consumers-for-cost-of-stranded-assets

- Pipeline information for users https://apga.org.au/pipeline-information-users

- Gas access arrangement review 2024-28 2023 https://www.aer.gov.au/system/files/ASG%20-%20Gas%20Access%20Arrangement%20review%202024-28%20-%20Addendum%20to%20proposal%20-%202%20September%202022%20-%20PUBLIC.pdf