Electric or EV Pickup trucks are available in China but only recently has there been announcements that EV Pickups are coming to many countries within the next 5 years. EV pickups for the western markets have been announced and the models will be available over the next 3 years. The primary market is the USA which has the highest number of pickup trucks (mostly full-size) but the mini and mid-size are in the rest of the world.

In some markets such as the USA Pickup trucks accounted for 20.57 percent of all vehicles in operation and SUVs 11.42 percent. Ford alone sells over 750,000 of the highest-selling pickup, the F150. Global car companies are listed in this article but only a few at this stage have made specific announcements with release dates and specifications. USA sales numbers are about 3m per year with over 14 pickup trucks and dozens of models. The biggest seller is the Ford 150. Check out the table of all announced vehicles. Descriptions are below the table.

Manufacturers of New EV Pickups

| Who | Model | First | Full | Numbers | Price | Features of the Pickup |

|---|---|---|---|---|---|---|

| Tesla | CyberTruck | 2022 | 2023 | 500,000 | $40k to $90 | 6,000kg towing, 2,000kg carrying, all wheel steer, 700 kW. Single, Tri, Quad motor |

| GM | Silverado | Spring 2023 | 2026 | 200,000 | $40k to $110k | 2 models, 400 mile, 3500kg towing, 660 HP, 500kg carrying weight, bidirectional charging |

| GM | Hummer | 2021 | 10,000. 26 in 2021 | $106k | 2023, 3 motors 619kW and 15,592Nm EVX3 not until 2023, ($100k) | |

| Ford | F150 Lightning | 2022 | 2024 | 150,000 | $42 up to $93k | 230 HP, bidirectional charging (VTH). Starts $40k up to $93k 4 trims Pro, XLT, Lariat, and Platinum; A 300mile will be $75k |

| Rivian | RT1, RS1 | 2021 | 2023 | 50,000 | $74k | RT1 300 miles of range 588kW quad-motor 4x4 ute. Tank Turn. Midsize, smaller than F150, bigger than Ford Ranger. Explore $68k. Adventure $75k |

| SAIC | LDV, Maxus T90 EV | 2022 | 2023 | 50,000 | $46k | 130 kW (174 HP), 310Nm (229 ft.lbs). 535 km (330 m) range, towing 2.5 tonne. 500kg payload. |

| Geely | considering | late 2022 | 2023 | 50,000 | has sub brand Farizon Auto Pick | |

| Toyota | Tacoma | 2024 | 202 | - | Concept only. No details | |

| VW | Considering | - | Possibly use ID.4 frame. | |||

| BMW | No plans | - | ||||

| Stellantis | RAM in USA | 2024 | TBA | Ram’s trucks will use the STLA platform | ||

| BYD | in developement | 2023 | TBA | Midsize - compete against For Ranger, Toyota HiLux, 450km range. | ||

| Magna | Drivetrain | 2024 | 4WD EV powertrain system designed specifically for pickup trucks and light commercial vehicles. | |||

| SEA | Hino, Conversion | 2017 | 20,000 | $25 | 3 year/150,000-kilometer warranty, Garbage trucks, buses, smaller trucks. USA, AUS, UK, NZ, EU, Rolls Royce and other vehicles | |

| Dongfeng / Nissan | Rich 5 | 2019 | $19k | Nissans pickup frame + dongfeng powertrain. Single 140 hp / 420 Nm. Double Cabin. 490kg load. 403km range | ||

| Lordsdown (Ohio USA) | Endurance | 2022 | Has Foxconn as partner Foxconn Lordsdown | |||

| Canoo | EV Skateboard | 2023 | 1,000 to Oklahomo | Canoo has offices in California and Texas, Michigan and plans to spend $560m in Minnesota. Canoo Website | ||

| Evage | Up to 5 models for India | 2022 | Indian startup, funded by RedBlue Capital | |||

| Bollinger Motors | Pickup, commercial | 2023 | Dropped to focus on commercial delivery trucks. | |||

| Magna Motors | Canada Drop in EV drive chain | 2021 | Magna Conversion unit | |||

| Safescape | Aussie Bortana EV Mine vehicle convesions, military trucks | 2021 | 4 per month Retrofit 2000 land cruisers | POA | Safescape Bortana EV mine vehicle Battery by 3ME Technology Aus |

|

| Zero Automotive | Zed 90 | 2021 | 1000 | POA | Land cruiser conversions | |

| Cenntro | iChassis, street sweeper, small truck, delivery vehicles | 2021 | 3600 | Recently acquired Tropos Motors EU Cenntro Electric group |

Australian Pickup Trucks

Australia has 20.1 m vehicles and the pickup or “ute” with cab chassis with 4×2 or 4×4 drivetrains accounts for about 20.6% of new sales. That is up from 15% in 2010. The breakdown of existing ICE sales is down the page.

Tesla EV Pickup – CyberTruck

Tesla announce their CyberTruck in 2018 and have taken over 1.3m (estimated) reservations. The vehicle is due to be manufactured in their Austin Texas 2022, due to delays in engineering and the requirement to use their new 4680 battery design. The delivery of batteries and steel supply will determine production.

Cybertruck first deliveries started on launch day, Dec 1st, 2023, with the base level at $61,000 available in 2025, and the dual motor more. Tesla has advised it will take up to 18 months to be at 250,000 deliveries.

If Tesla introduces a product at volume, it would be hard to see how many of the existing ICE pickups would survive the competition.

Ford EV Pickup Lightning

Ford announced the EV version of the F150 in 2021, and promising shipments in May 2022. Initially, they planned for 50,000 per year, but got over 200,000 reservations and have now decided to increase production to 150,000 by 2023. Their major new battery plants do not come online until 2025.

GM EV Pickups

General Motors has started to sell the GMC EV Hummer and EV Hummer EV SUV in 2021, then announced the electric Sierra, in the Denali trim. In Jan 2022, they extended their line up to their largest seller, the Silverado in 2 models. They announced they would bring forward their heavy truck (2500 models) to 2035 from 2040. GM has confirmed that five plants in North America will build all-electric vehicles: Spring Hill (TN), Factory Zero (MI), Orion Assembly (MI), CAMI (Ingersoll, Ontario, Canada), and Ramos Arizpe (Coahuila, Mexico) (InsideEV).

Toyota

Toyato ICE pickup trucks come in different sizes. A small 2×2, and mid size “normal” size such as Toyota Landcruiser and then extra large for the USA market. Most of the Toyota pickup trucks are smaller versions. They say that they “may” produce EV pickups, but there is nothing more than teasers. It may be that they use a Chinese partner to build them initially. While in Dec 2021, they doubled their “planned” EV production to 3.5m EVs by 2030, they have not made anything other than powerpoint presentations.

Rivian

Rivian, a new entrant, was partly funded by Amazon prior to their IPO. They have no existing ICE cars or pickups. They have 3 models and now shipping a delivery truck for Amazon. The pickup Truck (RT1) and SUV (RS1) are in early production and they target to sell over 50,000 by 2025 and 250,000 by 2030. While Amazon was an investor, it has teamed up with Stellantis STLA smart cockpit, which provides Alexa like control.

Lordsdown / Canoo / Bollinger

Lordstown (hub motor system) out of Ohio, Bollinger Motors from Detroit is focused on a light truck / van solution and Canoo from Arkansas and Oklahoma, are all startups in this space. While they started in the consumer market they appear to have moved to the light truck space, where EVS provide immediate financial returns.

Indian Manufacturers

EVage out of India have announced or beginning to ship a range of 5 pickups / trucks and first one is a 900kg truck for Amazon.

Dongfeng / Nissan

In 2019, Nissan body and Dongfeng have a $20,000 single motor pickup available in China.

SAIC / Geely / Great Wall

These manufacturers are planning to have these vehicles in USA as well as in China. They have some Chinese sales, and plan to be in Australia and US by late 2022.

Magna / SEA

Magna provides a drop-in replacement system – from 430 kW – 250kW from the rear eBeam and 180kW from the eDrive in the front – what may be most promising about eBeam is that it can be also dropped into an existing vehicle. As a result, eBeam can replace a traditional transmission and rear axle in a ladder frame chassis quite easily, leaving the existing brakes, suspension, and chassis itself as is. This unique design alleviates the need for any architectural changes to a vehicle and can be customized for OEMs to prioritize key performance attributes. (see electrik.co)

SEA is an Australian company that focuses on truck EV (new with Hino) but recently picked up a contract for 10,000 school buses. They say the cost of updating 3 buses is the same cost as 1 new EV bus. (check out their website or latest PR)

USA Existing ICE Pickup Trucks

The makeup of the 2021 top 20 best-sellers is in line with the longstanding, pre-Covid trend in U.S. sales towards trucks (pickups, SUVs, minivans) and away from cars. (Forbes 2021)

| Model | Numbers |

| Ford F-Series | 787,372 |

| Chevrolet Silverado | 593,057 |

| Ram Pickup | 563,676 |

| GMC Sierra | 253,014 |

| Toyota Tacoma | 238,805 |

| Toyota Tundra | 109,203 |

| Ford Ranger | 101,485 |

| Chevrolet Colorado | 96,236 |

| Jeep Gladiator | 77,541 |

| Nissan Frontier | 54,817 |

| Honda Ridgeline | 32,168 |

| Nissan Titan | 26,441 |

| GMC Canyon | 25,191 |

| Total | 2,959,006 |

Australia Existing ICE Pickup Trucks

Breakdown of the 200,000 annual sales of conventional trucks. The Thailand made Ranger is the largest seller. Note, it is smaller than the USA Ranger which is made in Michigan USA.

- 4×4 utes: 17.9 per cent

- Medium SUVs: 17.2 per cent

- Small SUVs: 14.2 per cent

- Large SUVs: 12.3 per cent

- Small cars: 10.4 per cent

| Australia Truck Sales | 2020 Sales |

| Ford Ranger | 53,100 |

| Toyota Hilux | 50,700 |

| Nissan Navara | 21,500 |

| Isuzu D-Max | 16900 |

| Toyota LandCruiser 70 Series | 14400 |

| Mazda BT-50 | 10500 |

| Mitsubishi Triton | 8900 |

| LDV T60 | 8700 |

| Great Wall Cannon | 8500 |

| Volkswagen Amarok | 6100 |

| Total | 199,300 |

Why Is USA Leader of Pick-ups?

Pickup trucks account for 6.4% of worldwide market in 2020. The top revenue was Ford ($25b), Toyota $24b, and GM ($22b).

Pickup trucks are a rare sight in Europe or China, but in the United States, they have a long history and an important place in the Passenger Cars Market. They were originally developed as modifications to the Ford Model T and the Ford Model TT by third-party manufacturers, but shortly after, companies like Dodge and Chevrolet followed. The production in the U.S. boomed after the introduction of the so-called “chicken tax” in 1963 banning the import of foreign pickups into the domestic market.

The real game changer was the introduction of the Corporate Average Fuel Economy policy in 1973. While many models from other classes of large passenger vehicles suffered from strict regulations concerning fuel economy, pickup trucks were subject to less stern emission standards. This led to pickups becoming a new favourite performance vehicle class for Americans, only to be challenged relatively recently by the rise of SUVs.

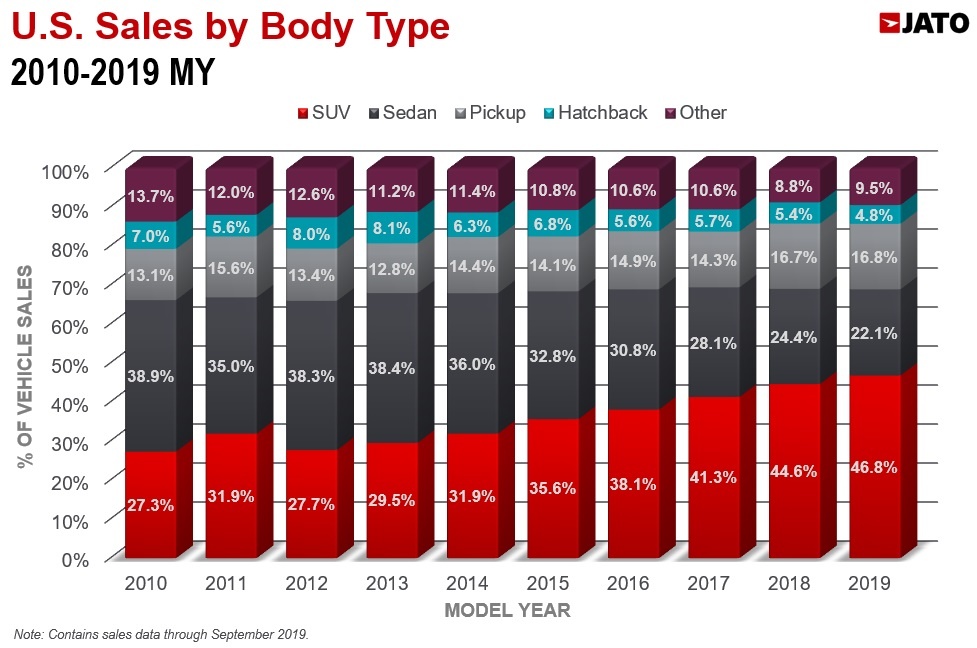

US Sales by Body Type

In the USA, over the past decade, the SUV has gained market share. Sedans have lost 50% of their share and hatchbacks lost share as well. Pickups have increased their share to about 17%.