While manufacturers continue to spruik fuel cell electric vehicles (FCEV) there are over ten reasons hydrogen for transportation is dead, including for cars. The game is over, but manufacturers are still saying FCEV have a life. Battery electric vehicles (BEV) have beaten the claimed advantages of FCEV conclusively. The only reason we continue to see FCEV is huge government subsidies.

- Most importantly is the lack of green hydrogen. FCEV are as dirty as internal combustion engines (ICE). There is no contribution from a switch to FCEV to meet climate goals, and this is probably for at least 10 years.

- Lack of filling stations is a second critical area. In 2022, there were 685 filling stations globally. Even in H2 countries such as Japan and Korea filling stations are <0.5% of electric chargers. Electric chargers are now more available than petrol / gas stations.

- Poor fuel efficiency is an insurmountable challenge.

But failure is also staring at 6,000 hydrogen buses globally.

Claimed advantages of FCEV

- Fast filling (5 minutes)

- Long range (350 miles – 500 km)

Ten Reasons Hydrogen for Transportation is dead

- Production of Green Hydrogen. 99% of all hydrogen produced today is dirty grey hydrogen. It will be a decade before green hydrogen is available in quantity.

- Cost of green hydrogen. The current cost is $10/kg or more. The cost will need to reduce to under $2/kg to be economic.

- The use of grey hydrogen is as dirty in emissions as running an ICE vehicle.

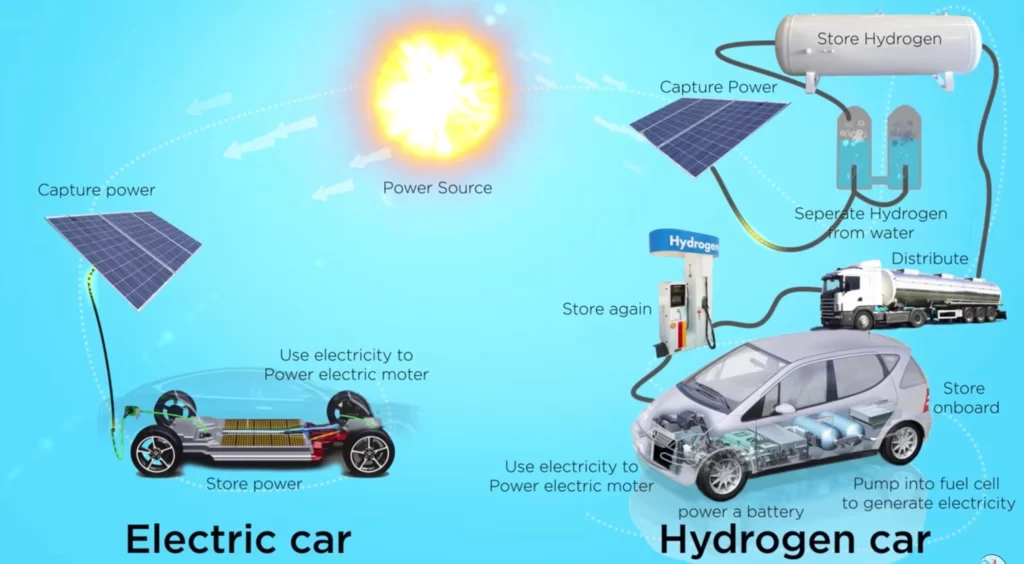

- Physics. The efficiency of renewable energy (e.g. solar) to motion in FCEV to BEV is 3 to 4 times less. For every 100kWh of renewable energy, a BEV provides 69kWh as motion. FCEV only 19kWh of motion

- Filling stations – there are 685 globally. Electric chargers are catching up to the number of petrol stations and with charging at home exceeds by orders of magnitude.

- Scaling, With less than 44,000 FCEVs globally, compared with over 14 million BEV. (end of 2023). That is less than 0.15% of BEV vehicles

- Battery costs continue to decrease. A bus company in France discovered cost of FCEV buses would be 6 times the cost of battery buses

- No ability to generate additional revenue from stored energy. Cars with V2G / V2H or buses can provide arbitrage of energy – being charged during the day and discharging at night (particularly with school buses)

- No general skilled repair services for FCEV vehicles

- BEV continue to improve charging speeds. Faster charging, and even 1MWh chargers enable 20 minute charging, Range has extended. Two years ago, only 3 car models had 350 mile (500km) range. Now over 42 models are in production or will be within 12 months.

Battery EV vs Fuel Cell EV Components

Latest Commentary

Michard Barnard has an updated view (2025) in Clean Technica, Debunking The Myth: Hydrogen Will Not Dominate The Transportation Sector [11]. He provides update of various companies gone out of business.

Production of Green Hydrogen

- Hydrogen is currently 99% produced from fossil fuel.

- Hydrogen “colour” is grey for production from fossil fuel, blue if fossil fuel with carbon capture or green if renewable energy is used in the production of the hydrogen.

- Over 99% of all H2 currently is grey – i.e. from fossil fuel.

- The largest green hydrogen production electrolyser in the world is 1.5MW. There are many who are looking to produce and ramp up. Quantities of hydrogen produced from green production is not expected until 2026 / 2027 and not until well after 2030/40 will green hydrogen meet current H2 use. (Note a major use of H2 is in oil refineries.) H2 needs to be transported from production to filling station for use. It will be a decade until there is sufficient green hydrogen production for use in transport and would need to compete for use in grid storage or green steel production..

- The largest planned green H2 production is currently in South Australia, with a 250MW electrolyser funded by Govt. Fortescue Mining (FFI), Plug Power, and others have plans for 2GW plus per year electrolyzer factories and also to build large renewable energy farms for the green energy to power the electrolyzers.

- Global electrolysis capacity could reach around 1.4 GW by the end of 2022, up from 0.4GW 2021.

- Global installations of electrolysers are set to expand by a factor of 120 — from 2GW in 2022 to 242GW — by 2030, according to BloombergNEF https://www.hydrogeninsight.com/electrolysers/chinese-companies-take-top-three-slots-in-bnefs-list-of-worlds-20-largest-hydrogen-electrolyser-makers/2-1-1355610

Cost of Green Hydrogen

A development time of green hydrogen at a cost of less than $2 per kg to make h2 powered vehicles economic. Green hydrogen is not yet produced in any great volume and when produced it is comparatively expensive. The figure from US Department of Energy was that the hydrogen was over $10 per kg which equates to a diesel price of $5 per gallon. The target of green hydrogen is to get the price down to $2 per kg by 2030.

Dirty Hydrogen Means FCEV are As Dirty as ICE Cars

For hydrogen to be zero emissions the hydrogen will need to be produced with 100% renewable energy. Only 3 countries currently have that level of renewable energy. There is no electrolzers currently running on 100% renewable energy.

Toyota gives the new Mirai fuel consumption at 0.86kgH2/100km, so running on grey H2 the Mirai emits around 94gCO2/km, whilst the NEXO (1kgH2/100km) emits around 109gCO2/km. These figures are only a marginal improvement on the CO2 tailpipe emissions of modern combustion engines… to be truly ‘green’, fuel-cell vehicles need green H2.

Fuel Efficiency of H2 Cars

| Car | Economy | Fuel Cost | Cost per km |

|---|---|---|---|

| ICE | 8 litres per 100km , 30MGP | $2 per liter | $0.16 |

| FCEV | 1kg per 100km | $10 kg | $0.10 |

| BEV | 16kWh per 100km | $0.30 retail /kWh | $0.05 |

Filling Stations

Filling stations are critical for wider use of hydrogen In 2021, 142 hydrogen filling stations opened throughout the world, a record number. In Europe, 37 new filling stations opened, 89 in Asia, and 13 in North America.. (https://energynews.biz/hydrogen-filling-stations-count-goes-to-142-worldwide-and-new-250-planned-in-europe)

| Country | Total | Notes |

|---|---|---|

| Japan | 159 | |

| Korea | 95 | 36 opened in 2021 |

| Australia | 2 | Melbourne and Canberra |

| USA | 86 mostly California | Planned 111 new ones |

| UK | 19 | |

| Germany | 101 | |

| Netherlands | 11 | |

| France | 41 | |

| Switzerland | 12 | |

| Total Europe | 228 | |

| China | 105 | Buses only |

| Total Globally | 33 countries, 685 end 2021 | Planned further 252 |

High Capital Cost of H2 Filling Stations

In 2020, a Department of Energy reviewed estimates for 111 new fueling stations selected for funding award in California. Capital cost ranged from $1,200 and $3,000 per kilogram hydrogen dispensed per day (kg/day), depending on daily fueling capacity and hydrogen delivery method. The station capacity ranged from approximately 770 kg/day to 1,620 kg/day, and all stations were designed with 700-bar fueling capability for light-duty vehicles. The average capital was $1.9 million each. In Australia with 4,600 gas stations capital investment for infrastructure would be $10b. Contrast that with electric, where every single 9.1 million households already have a 15amp plug for destination slow charging, with over 3,000 fast chargers.

An estimate from Fuel Cell at https://h2stationmaps.com/costs-and-financing showed similar costs but this was for bus systems. Hydrogen stations for transit buses cost approximately $5 million for a station that can fill up to 25 buses a day at 6-to-10 minutes per bus. The stations for USA AC Transit and Stark Area Regional Transit Authority have liquid delivery stations, and the SunLine Transit station has a large electrolyzer. Based on invoices from the one station, liquid hydrogen is being delivered for about $9 to $10 per kilogram. On an energy basis, this is equivalent to $4 to $5 per gallon of diesel.

Unreliable H2 Filling Stations

Hydrogen refuelling is an industry-wide challenge says Nel, a European operator of H2 filling stations

- Industry tried to do everything for everybody, everywhere, and that’s expensive- including a 32m write down by Nel

- In California, pumps frequently break down or run out of fuel, leaving hydrogen cars stranded and unable to refuel, or with nozzles frozen solid to vehicles, with customers begging Toyota to let them return their vehicles.

- A South Korean government report in 2021 revealed that the country’s 12 motorway hydrogen filling stations broke down a total of 221 times between April 2019 and August 2021.

Europe H2 Filling Stations

Registrations of new hydrogen fuel cell vehicles (FCEVs) are flatlining across most European markets, despite various companies’ plans to bring scores of new H2 refuelling stations (HRSs) online in several countries. New EU legislation mandates the construction of hundreds of new refuelling spots by 2027.

Sales of FCEV are Minuscule Compared to BEV

Sales of FCEV are less than 0.13% compared with PHEV and BEV, and falling. Do they have critical mass? Even PHEV are falling behind BEV.

- 2023: 9,511 sold (down 38.3%)

- 2022: 15,427 sold (no growth)

- 2021: 15,434 sold (peak)

The gap is widening. A total of 10.5 million new BEVs and PHEVs (plugin hybrid electric vehicles) were delivered during 2022 (https://www.ev-volumes.com/). PHEVs were 27% of global plug-in sales in 2022 (ie 2.8m vs 7.6 m compared to 29 % in 2021. While PHEV total sales are still climbing, their share in the PEV mix is in decline, facing headwinds from incentive cuts and improving BEV offers. Most industry analysts expect PHEV sales to fall, as full BEV become cheaper, have longer range and shorter recharge times. EV sales are expected to exceed 14.3m in 2023 bring the total globally to over 40million.

FCEV USA sales in 2021 were 16,195, up from 1600 in 2020. Total sales to date over the past 10 years is estimated at 44,000. In the USA in 2021 there were over 800,000 BEVs. 2022 sales were little changed with 28,000 FCEV sales but over 2m BEV.

FCEV Manufacturers

| Company | Model | Country | Stage |

|---|---|---|---|

| Hyundai | Nexo | Korea | 9591 sold Jan-Oct 2022 |

| Toyota | Mirai | Japan | 2897 sold Jan-Oct 2022 |

| Honda | Clarity | Japan | 208 sold Jan-Oct 2022 |

| SAIC | China | 198 sold Jan-Oct 2022 | |

| Great Wall | China | Announced | |

| Grove Hydrogen Automotors | China | Announced | |

| GAC Motors | China | Announced | |

| Opel (PSA group) | Zaira Van | France | testing |

| BMW | X5 | Germany | By late 2022 |

| H2O e-mobile GmbH | Germany | Development | |

| Hopium | France | Development | |

| Microcab Industries | UK | Development | |

| Jaguar Land Rover, | SUV | testing | |

| Ineos Automotive | SUV | France | testing |

| Viritech | UK | Testing | |

| Ronn Motor Group | USA | Development | |

| Hyperion | USA | Development | |

| Pininfarina S.p.A | Italy | Development | |

| Riverside Simple Movement | UK | Development | |

| Viritech | UK | Development |

The headlines say hydrogen car sales almost doubled last year, but this was with 50-65% discounts.

Increase in battery electric cars are now in the exponential growth phase and by 2030 expected to be 9 out of 10 cars sold

Fuel Efficiency

Toyota gives the new Mirai fuel consumption at 0.86kgH2/100km, so running on grey H2 the Mirai emits around 94gCO2/km, whilst the NEXO (1kgH2/100km) emits around 109gCO2/km. These figures are only a marginal improvement on the CO2 tailpipe emissions of modern combustion engines… to be truly ‘green’, fuel-cell vehicles need green H2.

H2 vehicle complexity

The six components all have technical challenges

- H2 tank – storage and refilling systems

- Fuel cell – range of manufacturers. Fuel cell operates at a standard rate hence the need for a battery and motors.

- Battery – small, but needed as in a petrol hybrid motor to provide variable speed

- Control system

- Electric motor – required to provide instant power.

- Regenerative brakes – feeding back into the battery

FCEV are similar to PHEV – in they have dual systems. Both require the battery and an electric motor. With this comes higher complexity and higher maintenance. Full battery electric vehicles may have up to 1 million miles (1.5m km) of warranty with fewer moving parts.

The tank has to cope with pressure and leakage. Leakage is about 1% per day. Otherwise, if the vehicle is in an enclosed space (garage) the H2 could result in explosions.

Fuel cells are improving, and there are a large number of fuel cell manufacturers.

Forecasts for H2 Cars

Some research says

he global hydrogen fuel cell vehicle market size was estimated at USD 1 billion in 2022 and is expected to hit around USD 69.61 billion by 2032, registering a CAGR of 52.9% from 2023 to 2032. This simply seems an exercise in wishful thinking.

Hydrogen for Buses

Globally, there are over 800,000 electric buses, and account for 21% of the total buses in service. Most are in China, but other countries will rapidly increase with over 48% of all new buses electric. The global new electric bus market size is projected to grow from 112,041 units in 2022 to reach 671,285 units by 2027, at a CAGR of 43.1%. In Europe, new electric buses are over 8,000 per year. Most cities who are members of the 100 Cities for carbon neutrality have switched all new bus purchases to BEV.

In contrast, there are 5,600 hydrogen buses, mostly in China. An article from Montpellier, a city in France, is revealing. They just cancelled an order for 50 Hydrogen buses. They said it would be six times more expensive than electric buses. So, they are giving up on hydrogen buses and buying electric and “will see in 2030 if hydrogen is cheaper.”

While the city might have been able to purchase the hydrogen buses for less money, they calculated that the cost of operation would be 0.95 euros ($1.08 USD) per km for hydrogen buses compared to 0.15 euros ($0.17 USD) per km for the battery-electric one.

The IRA Act in USA provides $1 billion in grants to purchase about 2,500 electric school buses in 400 school districts.

A number of school districts are converting from diesel to electric. E.g. Midwest bus services have over 10,000 electric conversions underway.

Direct Hydrogen Engines

This article deals with hydrogen fuel cell vehicles. There are also directly powered H2 vehicles that do not have a fuel cell. These are generally large diesel-like engines where the fuel system has been changed to use H2 directly – similar to the LNG CNG motors. Cummins has announced an engine for 2026, UK JCB has them now with adapted diesel engines for their construction equipment. Some mining companies have developed prototypes for heavy equipment. The rapid improvement in batteries and electric motors will see these H2 engines become redundant.

Hydrogen for Trucks

Batteries for light trucks will follow the car industry. The Ford F150 Lightning and the Tesla Cybertruck will become the standard for small trucks. Ford is using batteries in light trucks such as the Transit van. The heavy trucking industry has been slow to change but the launch of the Tesla Semi will drive batteries. Hydrogen is dead for trucks as well.

Hydrogen for Construction Equipment

JCB from UK is investing £100m of government grant money with a hundred engineers and have produced their 50th hydrogen engine. They have a prototype backhoe loader, and a Loadall telescopic handler, and just recently launched a specific H2 refueling vehicle. In contrast, they have produced over 1000 mini electric excavators, that runs for a day with a 2 hour charge.

It is hard to see past the hype. Almost certainly they use grey hydrogen so emissions will be greater than using diesel,

Planes – Electric or Hydrogen

Universal Hydrogen’s 40-passenger hydrogen electric plane completes its maiden flight in Feb 2023. Within weeks of experimental approval from FAA, a single H2 engine on Dash 300 test bed flew for 15 minutes. They have a further 2 years of developing a fully capable plane. Connect Airlines has secured the first US order to convert 75 ATR 72-600 planes to Universal Hydrogen powertrains with the purchase rights for 25 more. They intend to use modular freight containers for the H2 tanks.

New Atlas reports on their progress here in March 2024. They have progressed to having the H2 in 2 luggage container sized tanks, swappable. and claim the range on Dash-8 will be comparable to Jet Ai. Range is 460 miles (740 km) but the normal number of passengers (78) is reduced by 16. Universal Hydrogen says the numbers work. Maybe.

In this video explainer, Bernard van Dijk from the H2 Science Coalition investigates if hydrogen is a viable decarbonisation solution as an aircraft fuel and debunks some commonly made statements on hydrogen for aircraft.

Huge Government Subsidies

Hydrogen continues simply due to huge government subsidies.

- Japan in in 2020 increased subidies for clean vehicles. In that subside, FCEV got an increase of available subsidy to about $24,000, and up “by several hundred thousand yen” – from the already insanely high level of up to $21,000 (2.25 million yen) per vehicle (CleanTechica). In 2021 they allocated $2.3B (300Billion yen) for large scale supply of H2 and 0.5B (70B yen) for H2 production system (Reuters)

- Korea has similarly implemented huge subsidies for passenger cars – up to 50% of the cost borne by the tax payer. The Jan 2023 proposal sees millions of dollars lavished on up to 16,000 cars, 700 buses and 200 trucks and municipal waste collection vehicles.

- China – up to $20,000 for purchase

- For a interactive and detailed view, check out Fuel Cells and Hydrogen Observatory site. Most European countries, USA, Canada, China, Korea, Japan all have substantial subsidies either for purchase price, registration, taxes

Americas Cup H2 Chase Boats

Hydrogen for boutique uses will always be in the news (until money stops flowing). The defenders for the Cup in 2024, Emirates Team New Zealand, which won the regatta in 2021 for the fourth time, launched a foiling-power catamaran named Chase Zero last year. The Americas Cup is described by most as a billionaires folly. The HSV’s specifications—10m (33 feet), seats six people, top speed of 50 knots (100kmh) and a four-hour range at 30 knots, plus the ability to carry 250 kg more than 4 passengers.

References

- https://www.rechargenews.com/energy-transition/hydrogen-car-sales-almost-doubled-last-year-after-drivers-were-offered-50-65-discounts/2-1-1168221

- Michael Barnard Podcast on the Road to Transportation Decarbonisation

- Michael Barnard – All Ground Transportation will be Electric Illinium https://illuminem.com/illuminemvoices/all-ground-transportation-will-be-electric-but-you-wouldnt-know-it-from-media-and-investors

- Example of promotion: Planes, trains & ships: Hydrogen’s role in clean transport from Mitsubishi https://spectra.mhi.com/planes-trains-and-ships-hydrogens-role-in-clean-transport

- Video: Megawatt-scale liquid H2 airliner powertrain comes to life New Atlas Mar 2024 https://newatlas.com/aircraft/megawatt-liquid-h2-powertrain-aviation/

- Bouman, E. A., Lindstad, H. E., Rialland, A. I., & Strømman, A. H. (2017). State-of-the-art technologies for greenhouse gas emissions reduction in maritime transport. Transportation Research Part D: Transport and Environment, 52, 408–421.

- Brenna, M., Foiadelli, F., & Zaninelli, D. (2021). Comparative analysis of battery electric and hydrogen fuel cell vehicles: Efficiency, cost, and infrastructure. Energy Reports, 7, 5592–5604.

- International Council on Clean Transportation (ICCT). (2023). Hydrogen vs. Battery-Electric Aviation: Which is More Feasible?

- Rogstadius, J. (2023). Battery vs. hydrogen fuel cell road transport in Europe by 2035: A cost and efficiency analysis. International Journal of Hydrogen Energy, 48(5), 3021–3038.

- Schafer, A. W., Barrett, S. R. H., Doyme, K., Dray, L. M., Gnadt, A. R., Self, R., & O’Sullivan, A. (2018). Technological, economic, and environmental prospects of all-electric aircraft. Nature Energy, 3(3), 216–224.

- Debunking The Myth: Hydrogen Will Not Dominate The Transportation Sector Michael Barnard. 2025 https://cleantechnica.com/2025/03/24/debunking-the-myth-hydrogen-will-not-dominate-the-transportation-sector/

Japan H2 Policy Complete Failure

The Report: Japan’s “hydrogen society” policy “has clearly been a complete failure” (New Atlas) In 2017, Japan created a pioneering national hydrogen strategy, envisaging a carbon-neutral “hydrogen society.” But a Renewable Energy Institute report https://www.renewable-ei.org/pdfdownload/activities/REI_JapanHydrogenStrategy_EN_202209.pdf slams the policy as catastrophically misguided, with 70% of its 10-year budget “spent on bad ideas.”

- Targeted against bad uses

- Japan has prioritized dirty hydrogen

- The country’s green hydrogen production sector is lagging behind